Essay

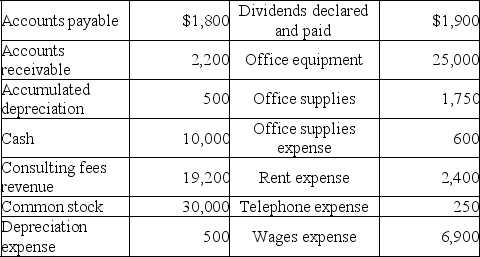

On September 1,2019,Fast Track,Inc.was started with $30,000 invested by the owners as contributed capital.On September 30,2019,the accounting records contained the following amounts:

Prepare an income statement for September for the first month of Fast Track's operation.Ignore income taxes.

Prepare an income statement for September for the first month of Fast Track's operation.Ignore income taxes.

Correct Answer:

Verified

Correct Answer:

Verified

Q80: Due to the relationship of financial statements,the

Q81: Which of the following transactions results in

Q82: Below are two related transactions for Golden

Q83: Which of the following correctly describes the

Q84: Which of the following does not correctly

Q86: Which of the following accounts would not

Q87: An accrued expense is incurred and paid

Q88: On September 1,2019,Fast Track,Inc.was started with $30,000

Q89: Depreciation expense is an estimated allocation of

Q90: Johnson Corporation is completing the accounting information