Essay

ROI and Residual Income

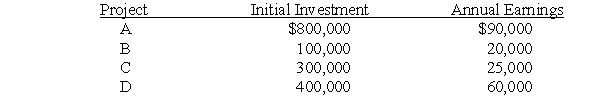

The following investment opportunities are available to an investment center manager:  Required:

Required:

a. If the investment manager is currently making a return on investment of 16 percent, which project(s) would the manager want to pursue?

b. If the cost of capital is 10 percent and the annual earnings approximate cash flows excluding finance charges, which project(s) should be chosen?

c. Suppose only one project can be chosen and the annual earnings approximate cash flows excluding finance charges. Which project should be chosen?

Correct Answer:

Verified

ROI and Residual Income

a. The ROI of t...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

a. The ROI of t...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: Overhead Variances<br>Overhead is applied on the basis

Q2: Choosing Performance Measures<br>Jen and Barry opened an

Q3: Materials Quantity Variance:Solving for Actual Quantity<br>Todco planned

Q4: Cost Allocation and Contingency Fees<br>A lawyer allocates

Q4: Describe ABC<br>Required:<br>a. What is activity-based costing and

Q6: Professional football teams have both a coach

Q9: Product Profitability and Mix - Calculating Variable

Q11: Job Cost Flows<br>The job cost sheet for

Q17: Fixed, Variable, and Average Costs<br>Midstate University is

Q18: Cost-volume-profit of a Make/buy Decision<br>Elly Industries is