Multiple Choice

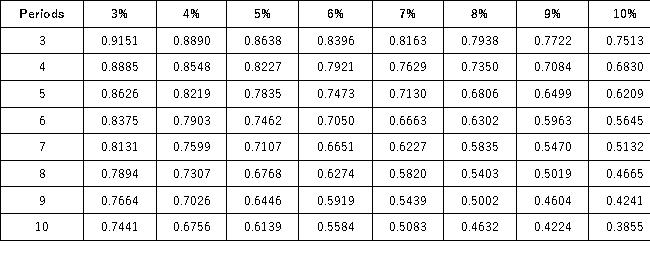

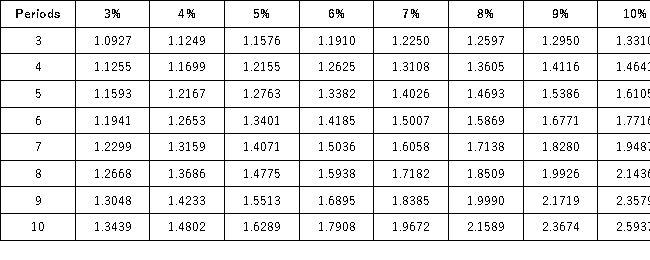

Present Value of 1  Future Value of 1

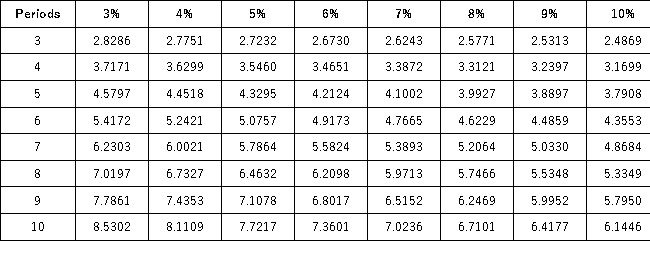

Future Value of 1  Present Value of an Annuity of 1

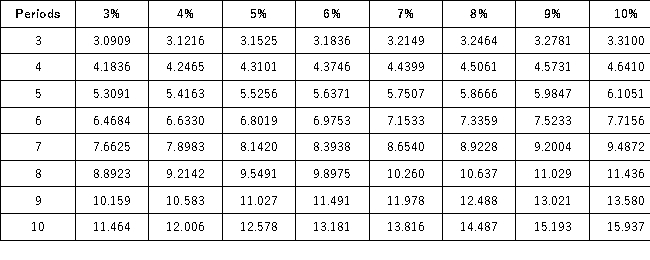

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Cody invests $1,800 per year from his summer wages at a 4% annual interest rate.He plans to take a European vacation at the end of 4 years when he graduates from college.How much will he have available to spend on his vacation?

Cody invests $1,800 per year from his summer wages at a 4% annual interest rate.He plans to take a European vacation at the end of 4 years when he graduates from college.How much will he have available to spend on his vacation?

A) $7,787.52

B) $7,488.00

C) $6,912.00

D) $7,200.00

E) $7,643.70

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2412/.jpg" alt="Present

Q13: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2412/.jpg" alt="Present

Q14: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2412/.jpg" alt="Present

Q15: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2412/.jpg" alt="Present

Q16: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2412/.jpg" alt="Present

Q18: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2412/.jpg" alt="Present

Q19: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2412/.jpg" alt="Present

Q20: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2412/.jpg" alt="Present

Q21: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2412/.jpg" alt="Present

Q22: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2412/.jpg" alt="Present