Multiple Choice

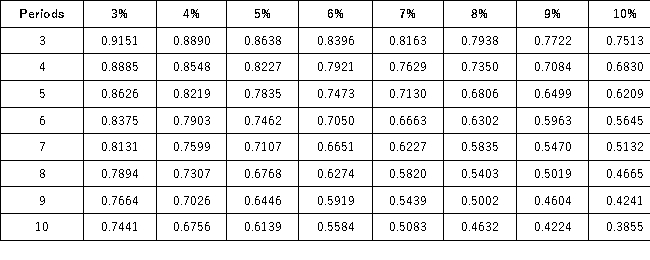

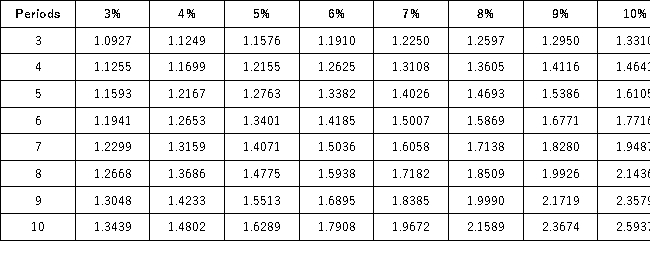

Present Value of 1  Future Value of 1

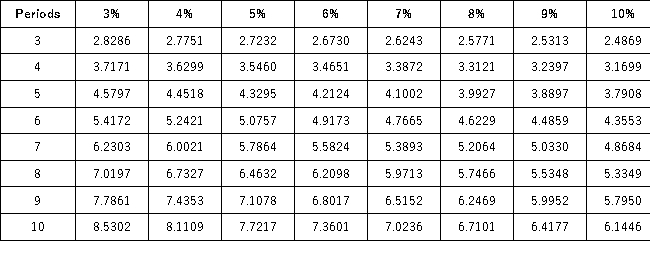

Future Value of 1  Present Value of an Annuity of 1

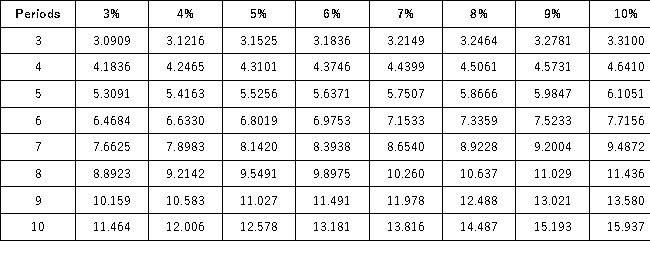

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  A company is considering an investment that will return $22,000 semiannually at the end of each semiannual period for 4 years.If the company requires an annual return of 10%,what is the maximum amount it is willing to pay for this investment?

A company is considering an investment that will return $22,000 semiannually at the end of each semiannual period for 4 years.If the company requires an annual return of 10%,what is the maximum amount it is willing to pay for this investment?

A) Not more than $69,738

B) Not more than $139,476

C) Not more than $88,000

D) Not more than $142,190

E) Not more than $176,000

Correct Answer:

Verified

Correct Answer:

Verified

Q14: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2412/.jpg" alt="Present

Q15: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2412/.jpg" alt="Present

Q16: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2412/.jpg" alt="Present

Q17: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2412/.jpg" alt="Present

Q18: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2412/.jpg" alt="Present

Q20: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2412/.jpg" alt="Present

Q21: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2412/.jpg" alt="Present

Q22: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2412/.jpg" alt="Present

Q23: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2412/.jpg" alt="Present

Q24: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2412/.jpg" alt="Present