Multiple Choice

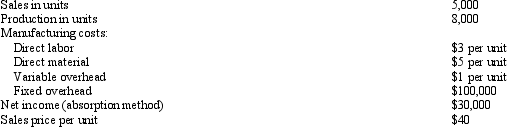

Austin Company The following information is available for Austin Company for its first year of operations: Refer to Austin Company.If Austin Company had used variable costing,what amount of income before income taxes would it have reported?

Refer to Austin Company.If Austin Company had used variable costing,what amount of income before income taxes would it have reported?

A) $30,000

B) ($7,500)

C) $67,500

D) cannot be determined from the information given

Correct Answer:

Verified

Correct Answer:

Verified

Q16: A _ is a planning document that

Q76: Sheets Corporation The following information was extracted

Q79: Letterman Corporation has the following data for

Q81: Cost allocation is the assignment of _

Q82: Alpha,Beta,and Gamma Companies Three new companies (Alpha,Beta,and

Q84: Kellman Corporation Kellman Corporation produces a single

Q85: Actual overhead exceeds applied overhead and the

Q116: Why do managers frequently prefer variable costing

Q131: In the application of "variable costing" as

Q158: If overapplied factory overhead is immaterial,the account