Multiple Choice

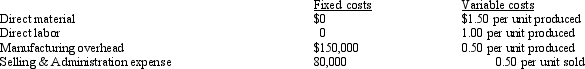

Kellman Corporation Kellman Corporation produces a single product that sells for $7.00 per unit.Standard capacity is 100,000 units per year; 100,000 units were produced and 80,000 units were sold during the year.Manufacturing costs and selling and administrative expenses are presented below.

There were no variances from the standard variable costs.Any under- or overapplied overhead is written off directly at year-end as an adjustment to cost of goods sold. Kellman Corporation had no inventory at the beginning of the year.

Kellman Corporation had no inventory at the beginning of the year.

Refer to Kellman Corporation.What is the net income under variable costing?

A) $50,000

B) $80,000

C) $90,000

D) $120,000

Correct Answer:

Verified

Correct Answer:

Verified

Q12: A performance measure that encompasses a firm's

Q30: Which of the following is not a

Q79: Letterman Corporation has the following data for

Q80: Austin Company The following information is available

Q81: Cost allocation is the assignment of _

Q82: Alpha,Beta,and Gamma Companies Three new companies (Alpha,Beta,and

Q85: Actual overhead exceeds applied overhead and the

Q87: In relationship to changes in activity,variable overhead

Q106: List and explain the four alternative measures

Q158: If overapplied factory overhead is immaterial,the account