Multiple Choice

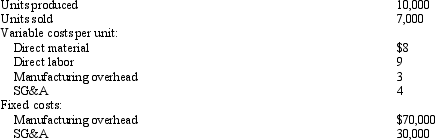

Bush Corporation The following information has been extracted from the financial records of Bush Corporation for its first year of operations: Refer to Bush Corporation.Based on absorption costing,what amount of period costs will Bush Corporation deduct?

Refer to Bush Corporation.Based on absorption costing,what amount of period costs will Bush Corporation deduct?

A) $70,000

B) $79,000

C) $30,000

D) $58,000

Correct Answer:

Verified

Correct Answer:

Verified

Q19: When a relationship between several independent variables

Q33: How do differences in sales and production

Q59: What factor,related to manufacturing costs,causes the difference

Q128: Another name for absorption costing is<br>A)full costing.<br>B)direct

Q138: Why is variable costing not used extensively

Q146: If overapplied factory overhead is material,the account

Q149: The costing technique that treats all manufacturing

Q157: In a actual cost system,factory overhead is

Q159: Oakwood Corporation Oakwood Corporation produces a single

Q160: If actual overhead is less than applied