Multiple Choice

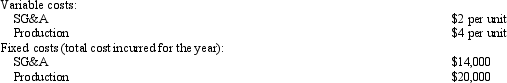

Oakwood Corporation Oakwood Corporation produces a single product.The following cost structure applied to its first year of operations: Refer to Oakwood Corporation.Assume for this question only that during the current year Oakwood Corporation manufactured 5,000 units and sold 3,800.There was no beginning or ending work-in-process inventory.How much larger or smaller would Oakwood Corporation's income be if it uses absorption rather than variable costing?

Refer to Oakwood Corporation.Assume for this question only that during the current year Oakwood Corporation manufactured 5,000 units and sold 3,800.There was no beginning or ending work-in-process inventory.How much larger or smaller would Oakwood Corporation's income be if it uses absorption rather than variable costing?

A) The absorption costing income would be $6,000 larger.

B) The absorption costing income would be $6,000 smaller.

C) The absorption costing income would be $4,800 larger.

D) The absorption costing income would be $4,000 smaller.

Correct Answer:

Verified

Correct Answer:

Verified

Q19: When a relationship between several independent variables

Q33: How do differences in sales and production

Q65: At its present level of operations,a small

Q128: Another name for absorption costing is<br>A)full costing.<br>B)direct

Q138: Why is variable costing not used extensively

Q146: If overapplied factory overhead is material,the account

Q149: The costing technique that treats all manufacturing

Q157: In a actual cost system,factory overhead is

Q158: Bush Corporation The following information has been

Q160: If actual overhead is less than applied