Essay

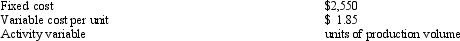

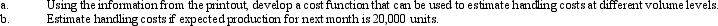

The facility manager of Price Corporation asked the systems analyst for information to help in forecasting handling costs.The following printout was generated using the least squares regression method.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: In a normal cost system,factory overhead is

Q13: The costing system that classifies costs by

Q21: A short-run measure of activity that represents

Q50: If actual overhead is less than applied

Q77: Absorption costing conforms with generally accepted accounting

Q81: If production exceeds sales,absorption costing net income

Q93: An ending inventory valuation on an absorption

Q110: Variable costing has an advantage over absorption

Q189: McFatter Office Supply Company has the following

Q196: When using the high-low method,the variable component