Essay

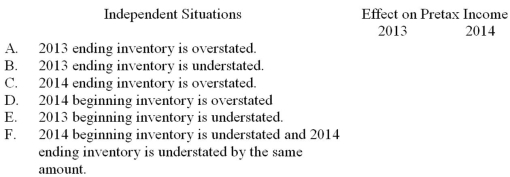

For each independent situation given below, determine the effect on pretax income for each. Enter "O" to indicate pretax income is overstated, "U" to indicate pretax income is understated, or "NA" to indicate that pretax income is not affected.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Coleman Company has provided the following information:

Q11: The inventory records of Martin Corporation reflected

Q15: Maxim Corp. has provided the following

Q16: QV-TV, Inc. provided the following items in

Q17: Lauer Corporation uses the periodic inventory

Q19: Redford Company hired a new store manager

Q41: Which of the following statements is correct?<br>A)FIFO

Q45: Manufactured goods transferred out of work in

Q72: Which of the following businesses would not

Q93: Which of the following is correct?<br>A)The raw