Essay

Redford Company hired a new store manager in October 2013, who determined the ending inventory on December 31, 2013, to be $50,000. In March, 2014, the company discovered that the December 31, 2013 ending inventory should have been $58,000. The December 31, 2014, inventory was correct. Ignore income taxes.

Required:

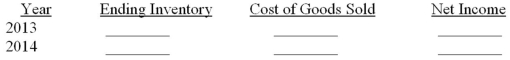

Complete the following table to show the effects of the inventory error on the four amounts listed. Give the amount of the discrepancy and indicate whether it was overstated (O), understated (U), or had no effect (N).

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Which of the following costs is not

Q14: For each independent situation given below, determine

Q15: Maxim Corp. has provided the following

Q16: QV-TV, Inc. provided the following items in

Q17: Lauer Corporation uses the periodic inventory

Q22: Lauer Corporation uses the periodic inventory

Q37: Which of the following statements is incorrect?<br>A)A

Q45: Manufactured goods transferred out of work in

Q65: Which of the following statements is incorrect

Q74: During periods of decreasing unit costs,use of