Paul & Stephan: on January 1, 20X1, Paul, Inc On January 2, 20X3, Stephan Sold 2,000 Additional Shares in a 90

Essay

Paul & Stephan: On January 1, 20X1, Paul, Inc. acquired a 90% interest in Stephan Company. The $45,000 excess of purchase price (parent's share only) was attributable to goodwill. On January 1, 20X3, Stephan Company had the following stockholders' equity:

On January 2, 20X3, Stephan sold 2,000 additional shares in a private offering.

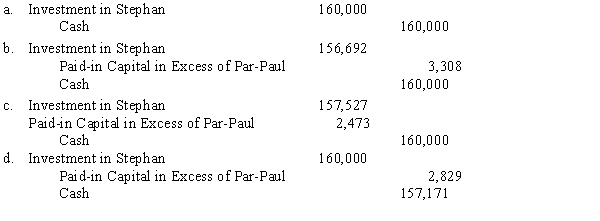

-Refer to Paul and Stephan. Stephan issued the new shares for $80 per share; Paul, Inc. purchased all the shares. What is the journal entry that Paul will prepare to record this investment?

Correct Answer:

Verified

C

1 (9,000 + 2,000) ÷ (10,000 + ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

1 (9,000 + 2,000) ÷ (10,000 + ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: Able Company owns an 80% interest in

Q7: On 1/1/X1 Poncho acquired an 80%

Q8: Apple Inc. owns a 90% interest in

Q9: Able Company owns an 80% interest in

Q11: On January 1, 20X1, Parent Company purchased

Q12: Apple Inc. purchased a 70% interest

Q13: Porter & Solheim: On January 1,

Q14: Company P purchased a 80% interest

Q15: Parrot, Inc. purchased a 60% interest in

Q21: Two types of intercompany stock purchases significantly