Short Answer

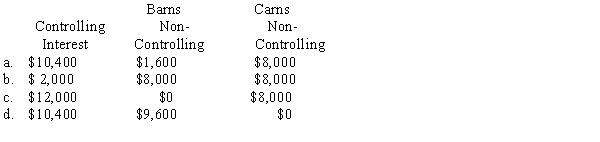

Able Company owns an 80% interest in Barns Company and a 20% interest in Carns Company. Barns owns a 40% interest in Carns Company. The reported income of Carns is $20,000 for 20X4. Which of the following shows how it will be distributed?

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: On January 1, 20X1, Parent Company purchased

Q2: Which of the following situations is a

Q3: On January 1, 20X1, Parent Company

Q4: Paula Inc. purchased an 80% interest

Q7: On 1/1/X1 Poncho acquired an 80%

Q8: Apple Inc. owns a 90% interest in

Q9: Able Company owns an 80% interest in

Q10: Paul & Stephan: On January 1,

Q11: On January 1, 20X1, Parent Company purchased

Q21: Two types of intercompany stock purchases significantly