Essay

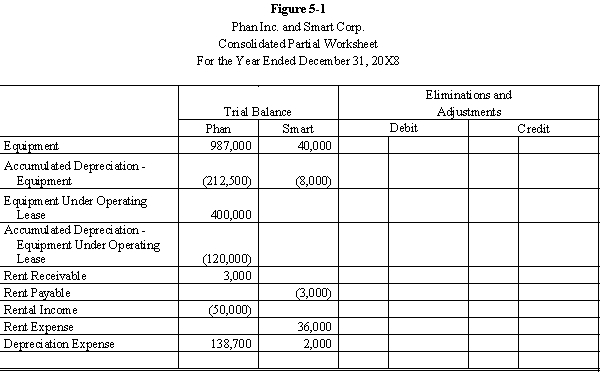

Smart Corporation is a 90%-owned subsidiary of Phan Inc. On January 2, 20X6, Smart agreed to lease $400,000 of construction equipment from Phan for $3,000 a month on an operating lease. The equipment has a 10-year life and is being depreciated using the straight-line method.

Required:

Prepare the eliminations and adjustments required by the intercompany lease on the Figure 5-1 partial worksheet for December 31, 20X8. Key and explain all eliminations and adjustments.

Correct Answer:

Verified

For the worksheet solution, please refer...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: Company S is a 100%-owned subsidiary of

Q31: Phil Company leased a machine to its

Q32: Lion Company leased equipment to its wholly

Q33: Tempo Industries is an 80%-owned subsidiary of

Q33: Company S is a 100%-owned subsidiary of

Q37: On January 1, 20X8, Pope Company acquired

Q38: The parent company leased a machine to

Q39: On January 1, 20X1, Parent Company acquired

Q40: Powell Company owns an 80% interest in

Q46: The purchase of outstanding subsidiary bonds by