Essay

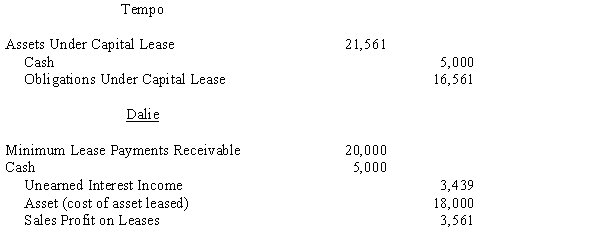

Tempo Industries is an 80%-owned subsidiary of Dalie Inc. On January 1, 20X8, Dalie leased an asset to Tempo and the following journal entries were made:

The terms of the lease agreement require Tempo to make five payments of $5,000 each at the beginning of each year. The implicit interest rate used by both Dalie and Tempo is 8%.

The terms of the lease agreement require Tempo to make five payments of $5,000 each at the beginning of each year. The implicit interest rate used by both Dalie and Tempo is 8%.

Required:

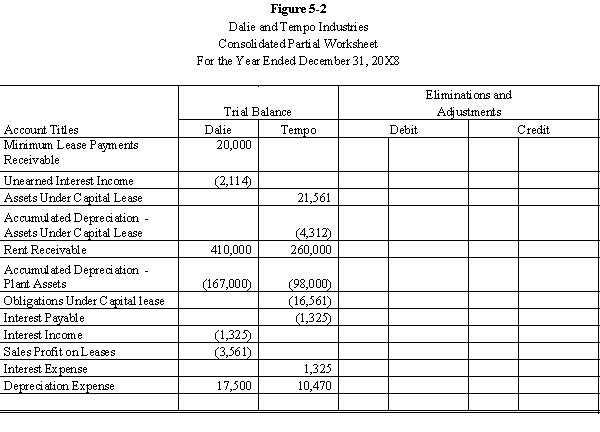

Prepare the eliminations and adjustments required by the intercompany lease on the Figure 5-2 partial worksheet of December 31, 20X8. Key and explain all eliminations and adjustments.

Correct Answer:

Verified

For the worksheet solution, please refer...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: Company S is a 100%-owned subsidiary of

Q29: Soap & Pumice: Soap Company issued $200,000

Q31: Phil Company leased a machine to its

Q32: Lion Company leased equipment to its wholly

Q33: Company S is a 100%-owned subsidiary of

Q35: Smart Corporation is a 90%-owned subsidiary of

Q37: On January 1, 20X8, Pope Company acquired

Q38: The parent company leased a machine to

Q45: When one member of a consolidated group

Q46: The purchase of outstanding subsidiary bonds by