Multiple Choice

Scenario 2-1

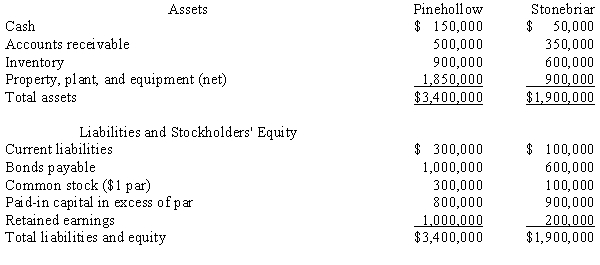

Pinehollow acquired all of the outstanding stock of Stonebriar by issuing 100,000 shares of its $1 par value stock. The shares have a fair value of $15 per share. Pinehollow also paid $25,000 in direct acquisition costs. Prior to the transaction, the companies have the following balance sheets:

The fair values of Stonebriar's inventory and plant, property and equipment are $700,000 and $1,000,000, respectively.

The fair values of Stonebriar's inventory and plant, property and equipment are $700,000 and $1,000,000, respectively.

-Refer to Scenario 2-1. Goodwill associated with the purchase of Stonebriar is ____.

A) $100,000

B) $125,000

C) $300,000

D) $325,000

Correct Answer:

Verified

Correct Answer:

Verified

Q9: On December 31, 20X1, Parent Company purchased

Q19: When a company purchases another company that

Q20: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3676/.jpg" alt=" Assuming Investor owns

Q21: Supernova Company had the following summarized balance

Q22: Parr Company purchased 100% of the voting

Q23: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3676/.jpg" alt=" Answer the following

Q24: Scenario 2-1<br>Pinehollow acquired all of the outstanding

Q25: Which of the following costs of a

Q26: Supernova Company had the following summarized balance

Q37: On January 1, 20X1, Parent Company purchased