Essay

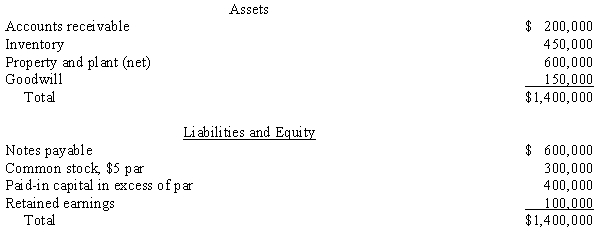

Supernova Company had the following summarized balance sheet on December 31, 20X1:

The fair value of the inventory and property and plant is $600,000 and $850,000, respectively.

The fair value of the inventory and property and plant is $600,000 and $850,000, respectively.

Assume that Redstar Corporation exchanges 75,000 of its $3 par value shares of common stock, when the fair price is $20/share, for 100% of the common stock of Supernova Company. Redstar incurred acquisition costs of $5,000 and stock issuance costs of $5,000.

Required:

a.

What journal entry will Redstar Corporation record for the investment in Supernova?

b.

Prepare a supporting value analysis and determination and distribution of excess schedule

c.

Prepare Redstar's elimination and adjustment entry for the acquisition of Supernova.

Correct Answer:

Verified

*alternative treatme...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: On December 31, 20X1, Parent Company purchased

Q19: When a company purchases another company that

Q20: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3676/.jpg" alt=" Assuming Investor owns

Q21: Supernova Company had the following summarized balance

Q22: Parr Company purchased 100% of the voting

Q23: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3676/.jpg" alt=" Answer the following

Q24: Scenario 2-1<br>Pinehollow acquired all of the outstanding

Q25: Which of the following costs of a

Q28: Scenario 2-1<br>Pinehollow acquired all of the outstanding

Q37: On January 1, 20X1, Parent Company purchased