Multiple Choice

Scenario 10-2

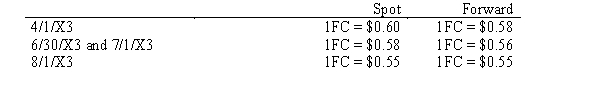

On 4/1/X3, a U.S. Company commits to sell a piece of equipment to a French customer. At that time, the U.S. company enters into a forward contract to sell foreign currency on 8/1/X3 (120 days) . Delivery will take place 7/1/X3 with payment due on 8/1/X3. The fiscal year end for the company is 6/30/X3. The sales price of the equipment is 200,000 Euros. Various exchange rates are as follows:

Discount rate is 12%.

Discount rate is 12%.

-Refer to Scenario 10-2. What is the amount in the Firm Commitment account on 6/30/X3?

A) 4,000 debit

B) 8,000 debit

C) 4,000 credit

D) 10,000 credit

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Exchange gains and losses on a forward

Q2: The purpose of a hedge on an

Q3: Zerlie's Imports purchased automotive parts from a

Q7: A U.S. company purchases medical lab equipment

Q8: On November 1, 20X1, DEMO Corp., a

Q11: On September 15, 20X2, Wall Company, a

Q12: A United States based company that has

Q41: A U.S. Corp. purchased a computer from

Q43: The best definition for direct quotes would

Q49: A U.S. manufacturer has sold goods to