Essay

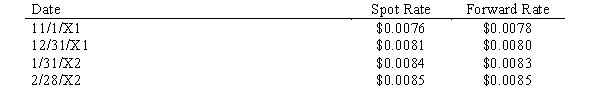

Rex Corporation, a U.S. firm with a calendar accounting year, agreed to buy a specially made truck from a Japanese firm for delivery on January 31, 20X2 with payment due on 2/28/X2. On the same date the agreement was signed, November 1, 20X1, a forward contract due on February 28, 20X2, was also signed to purchase 1,000,000 yen, the contract price of the truck. Exchange rates were as follows:

Discount rate = 8%

Discount rate = 8%

Required:

Prepare the journal entries needed to properly reflect the purchase and forward contract through the end of the fiscal year.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Differentiate between the following monetary systems: floating

Q20: Foreign currency transactions not involving a hedge

Q42: A U.S. firm has purchased, for 50,000

Q43: Red & Blue Company, a U.S. corporation,

Q45: A U.S. manufacturer has sold computer services

Q46: Bulldog Enterprise, a U.S. firm, agreed on

Q48: Which of the following is not true

Q51: Wolters Corporation is a U.S. corporation that

Q52: In the accounting for forward exchange contracts,

Q59: Describe the risks and uncertainty a U.S.company