Essay

Bulldog Enterprise, a U.S. firm, agreed on February 1, 20X1, to buy gears from a Mexican firm for 75,000 pesos. Delivery is scheduled for April 1, 20X1, with payment due on May 1, 20X1. On February 1, 20X1, Bulldog also acquired a forward contract to buy 75,000 pesos on May 1, 20X1. (The gears represent inventory to the U.S. firm.) There are no fiscal period ends.

Required:

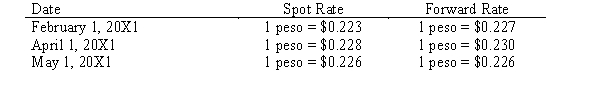

Prepare the journal entries necessary for Bulldog Enterprise to record this activity. Assume that the following exchange rates existed:

Discount rate

Discount rate  15%

15%

Correct Answer:

Verified

Correct Answer:

Verified

Q8: In a hedge of a forecasted transaction,

Q13: Differentiate between the following monetary systems: floating

Q20: Foreign currency transactions not involving a hedge

Q42: A U.S. firm has purchased, for 50,000

Q43: Red & Blue Company, a U.S. corporation,

Q45: A U.S. manufacturer has sold computer services

Q47: Rex Corporation, a U.S. firm with a

Q48: Which of the following is not true

Q51: Wolters Corporation is a U.S. corporation that

Q59: Describe the risks and uncertainty a U.S.company