Short Answer

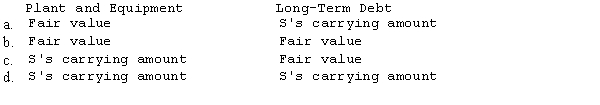

Company B acquired the net assets of Company S in exchange for cash. The acquisition price exceeds the fair value of the net assets acquired. How should Company B determine the amounts to be reported for the plant and equipment, and for long-term debt of the acquired Company S?

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q4: Polk issues common stock to acquire all

Q8: In performing impairment test for goodwill,

Q9: Mans Company is about to purchase

Q10: Balter Inc. acquired Jersey Company on

Q12: Cozzi Company is being purchased and

Q14: The Blue Reef Company purchased the

Q15: Poplar Corp. acquires the net assets

Q16: ACME Co. paid $110,000 for the net

Q17: On January 1, 20X1 the fair

Q18: Separately identified intangible assets are accounted for