Short Answer

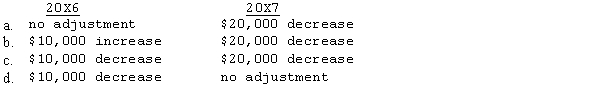

In performing impairment test for goodwill, the company had the following 20X6 and 20X7 information available. Assume that the carry value of the identifiable assets are a reasonable approximation of their fair values. Based upon this information what are the 20X6 and 20X7 adjustment to goodwill, if any?

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Publics Company acquired the net assets

Q4: An economic advantage of a business combination

Q4: Polk issues common stock to acquire all

Q5: Which of the following income factors should

Q7: Goodwill represents the excess cost of an

Q9: Mans Company is about to purchase

Q10: Balter Inc. acquired Jersey Company on

Q12: Cozzi Company is being purchased and

Q13: Company B acquired the net assets of

Q20: A controlling interest in a company implies