Essay

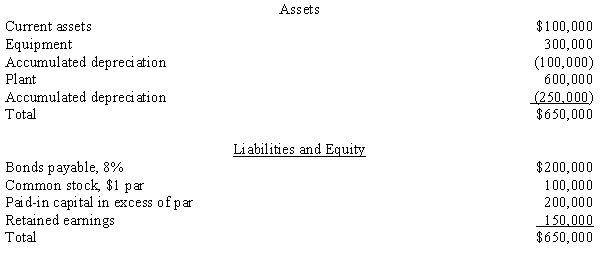

The Chan Corporation purchased the net assets (existing liabilities were assumed) of the Don Company for $900,000 cash. The balance sheet for the Don Company on the date of acquisition showed the following:

Required:

Required:

The equipment has a fair value of $300,000, and the plant assets have a fair value of $500,000. Assume that the Chan Corporation has an effective tax rate of 40%. Prepare the entry to record the purchase of the Don Company for each of the following separate cases with specific added information:

a.

The sale is a nontaxable exchange to the seller that limits the buyer to depreciation and amortization on only book value for tax purposes.

b.

The bonds have a current fair value of $190,000. The transaction is a taxable exchange.

c.

There are $100,000 of prior-year losses that can be used to claim a tax refund. The transaction is a taxable exchange.

d.

There are $150,000 of past losses that can be carried forward to future years to offset taxes that will be due. The transaction is a nontaxable exchange.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: A tax advantage of business combination can

Q11: Acquisition costs such as the fees of

Q19: Vibe Company purchased the net assets of

Q21: On January 1, 20X5, Zebb and Nottle

Q22: ACME Co. paid $110,000 for the net

Q25: On January 1, 20X5, Brown Inc.

Q27: Diamond acquired Heart's net assets. At

Q28: When an acquisition of another company occurs,

Q29: Internet Corporation is considering the acquisition

Q37: Goodwill is an intangible asset.There are a