Essay

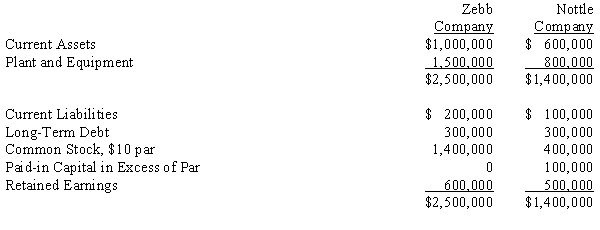

On January 1, 20X5, Zebb and Nottle Companies had condensed balance sheets as shown below:

Required:

Required:

Record the acquisition of Nottle's net assets, the issuance of the stock and/or payment of cash, and payment of the related costs. Assume that Zebb issued 30,000 shares of new common stock with a fair value of $25 per share and paid $500,000 cash for all of the net assets of Nottle. Acquisition costs of $50,000 and stock issuance costs of $20,000 were paid in cash. Current assets had a fair value of $650,000, plant and equipment had a fair value of $900,000, and long-term debt had a fair value of $330,000.

Correct Answer:

Verified

*alternative treatm...

*alternative treatm...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: A tax advantage of business combination can

Q11: Acquisition costs such as the fees of

Q16: ACME Co. paid $110,000 for the net

Q17: On January 1, 20X1 the fair

Q18: Separately identified intangible assets are accounted for

Q19: Vibe Company purchased the net assets of

Q22: ACME Co. paid $110,000 for the net

Q24: The Chan Corporation purchased the net assets

Q25: On January 1, 20X5, Brown Inc.

Q37: Goodwill is an intangible asset.There are a