Multiple Choice

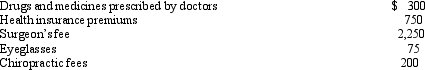

Joyce had adjusted gross income of $28,000 in 2011.During the year,she incurred and paid the following medical expenses:  Joyce received $1,250 in 2011 as a reimbursement for a portion of the surgeon's fee.If Joyce were to itemize her deductions,what would be her allowable medical expense deduction after the adjusted gross income limitation is taken into account?

Joyce received $1,250 in 2011 as a reimbursement for a portion of the surgeon's fee.If Joyce were to itemize her deductions,what would be her allowable medical expense deduction after the adjusted gross income limitation is taken into account?

A) $3,575

B) $3,375

C) $225

D) $25

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Hortense had adjusted gross income in 2011

Q11: Janet and Andrew paid the following amounts

Q13: Which of the following is not deductible

Q13: Which of the following is not deductible

Q14: Which of the following miscellaneous itemized deductions

Q16: During 2011,Mary,a single taxpayer,had $3,750 of interest

Q17: Please choose the true statement.<br>A)A charitable contribution

Q18: A difference between a Section 529 Plan

Q19: Polly is a telephone service person employed

Q20: For 2011,Till and Larry had adjusted gross