Multiple Choice

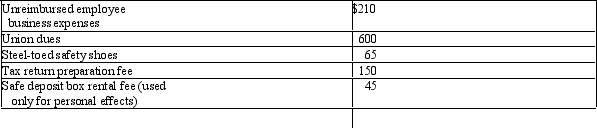

Polly is a telephone service person employed by a telephone repair firm.During 2011,she paid the following miscellaneous expenses:  If Polly were to itemize her deductions in 2011,what amount could she claim as miscellaneous itemized deductions (before applying the 2 percent of adjusted gross income limitation) ?

If Polly were to itemize her deductions in 2011,what amount could she claim as miscellaneous itemized deductions (before applying the 2 percent of adjusted gross income limitation) ?

A) $1,070

B) $1,025

C) $960

D) $875

E) $810

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Janet and Andrew paid the following amounts

Q13: Which of the following is not deductible

Q13: Which of the following is not deductible

Q14: Which of the following miscellaneous itemized deductions

Q15: Joyce had adjusted gross income of $28,000

Q16: During 2011,Mary,a single taxpayer,had $3,750 of interest

Q17: Please choose the true statement.<br>A)A charitable contribution

Q18: A difference between a Section 529 Plan

Q20: For 2011,Till and Larry had adjusted gross

Q21: Which of the following is deductible as