Multiple Choice

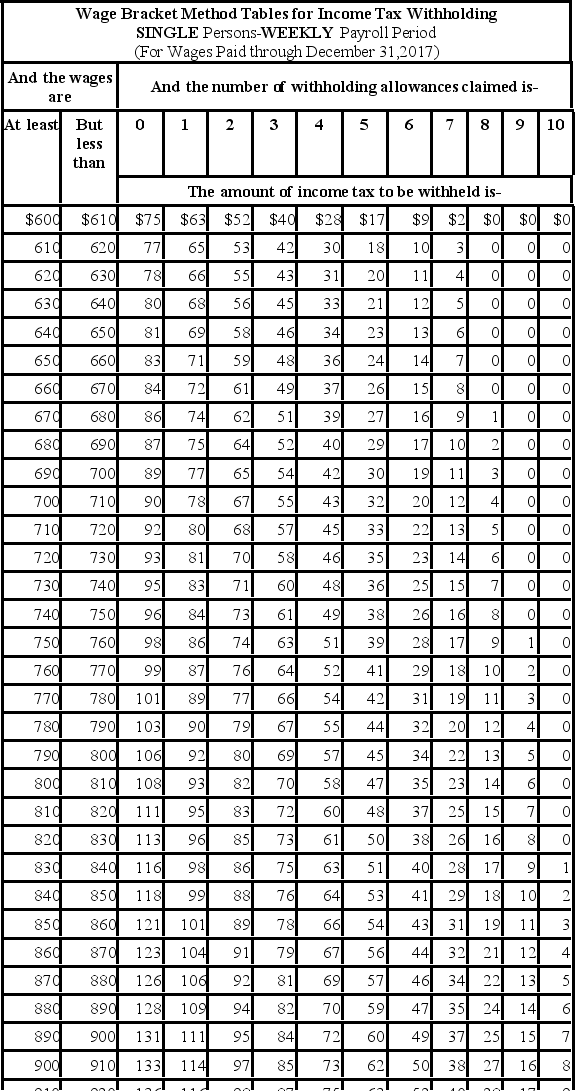

Andie earned $680.20 during the most recent weekly pay period. She is single with 3 withholding allowances and needs to decide between contributing 2.5% and $25 to her 401(k) plan. If she chooses the method that results in the lowest taxable income, how much will be withheld for Federal income tax (based on the following table) ?

A) $61.00

B) $59.00

C) $48.00

D) $49.00

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Which of the following federal withholding allowance

Q21: What is a disadvantage to using paycards

Q36: A firm has headquarters in Indiana,but has

Q43: Disposable income is defined as:<br>A)An employee's net

Q60: Which of the following is used in

Q62: Ramani earned $1,698.50 during the most recent

Q63: Vivienne is a full-time exempt employee in

Q65: Steve is a full-time exempt employee at

Q69: Melody is a full-time employee in Sioux

Q70: Trish earned $1,734.90 during the most recent