Multiple Choice

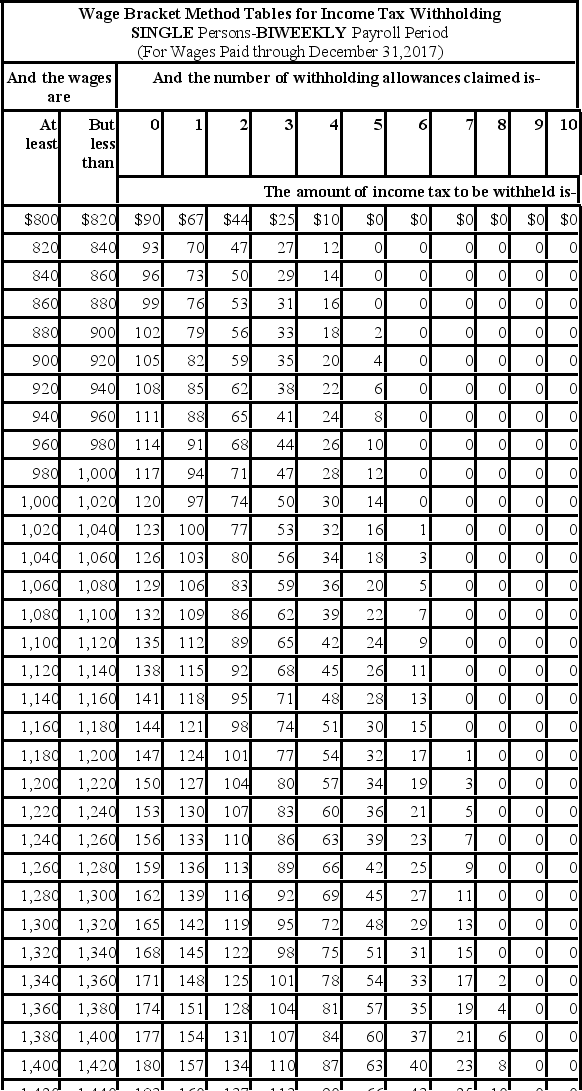

Julian is a part-time nonexempt employee in Nashville, Tennessee, who earns $21.50 per hour. During the last biweekly pay period he worked 45 hours, 5 of which are considered overtime. He is single with one withholding allowance (use the wage-bracket table) . What is his net pay? (Do not round interim calculations, only round final answer to two decimal points.)

A) $818.40

B) $797.18

C) $825.99

D) $843.12

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Federal income tax, Medicare tax, and Social

Q15: Garnishments are court-ordered amounts that an employer

Q33: The regular Medicare tax deduction is 1.45%

Q37: Warren is a married employee with six

Q38: Amanda is a full-time exempt employee in

Q39: How are income taxes and FICA taxes

Q40: Brent is a full-time exempt employee in

Q43: Which of the following statements is/are true

Q46: State and Local Income Tax rates _.<br>A)exist

Q46: Olga earned $1,558.00 during the most recent