Multiple Choice

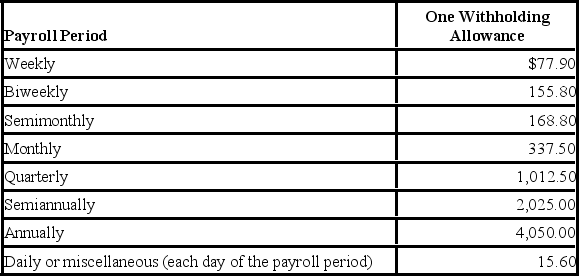

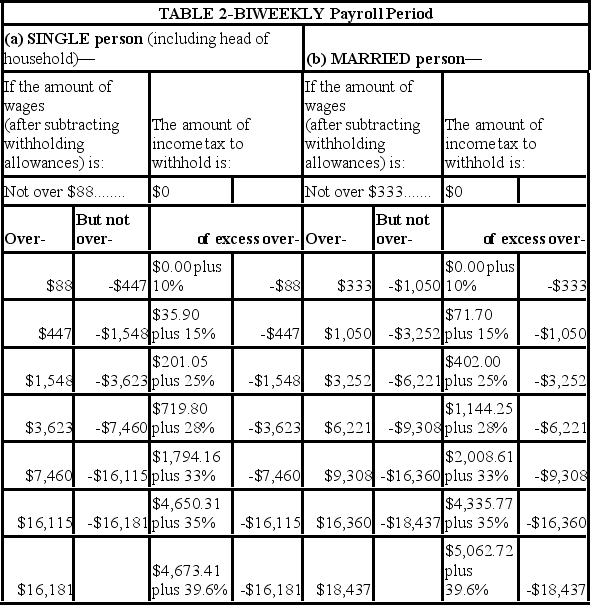

Warren is a married employee with six withholding allowances. During the most recent biweekly pay period, he earned $9,450.00. Using the percentage method, compute Warren's federal income tax. (Do not round interim calculations, only round final answer to two decimal points.) Table 5. Percentage Method-2017 Amount for one Withholding Allowance

A) $2,490.15

B) $2,156.90

C) $2,012.91

D) $1,786.63

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Which of the following payment methods is

Q32: Nickels Company is located in West Virginia

Q33: The regular Medicare tax deduction is 1.45%

Q34: Tierney is a full-time nonexempt salaried employee

Q35: Sammy contributes 4% of her salary to

Q38: Amanda is a full-time exempt employee in

Q39: How are income taxes and FICA taxes

Q40: Brent is a full-time exempt employee in

Q41: Julian is a part-time nonexempt employee in

Q46: State and Local Income Tax rates _.<br>A)exist