Multiple Choice

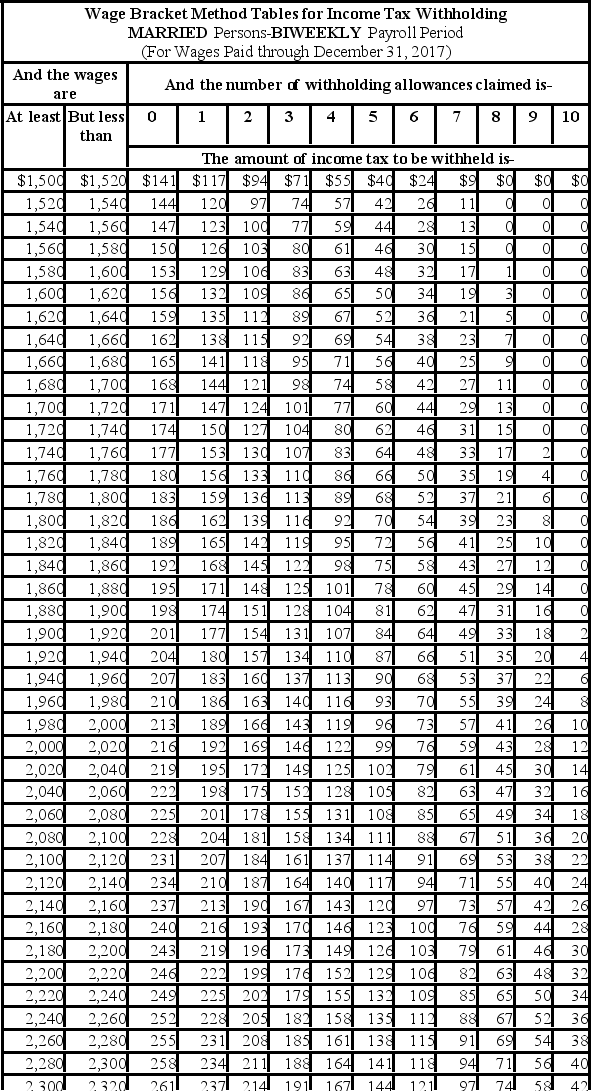

Manju is a full-time exempt employee living in Illinois who earns $43,680 annually and is paid biweekly. She is married with three withholding allowances. What is the total of her Federal and state income tax deductions for the most recent pay period? (Use the wage bracket tables. Illinois state income tax rate is 3.75%.)

A) $161

B) $162

C) $158

D) $166

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Which are steps in the net pay

Q13: Max earned $1,019.55 during the most recent

Q17: Renee is a salaried exempt employee who

Q18: The wage-bracket of determining federal tax withholding

Q18: Which of the following states do not

Q19: Janna is a salaried nonexempt employee in

Q20: Computation of net pay involves deducting mandatory

Q20: Which of the following statements is/are true

Q35: Amity is an employee with a period

Q61: Why do employers use checks as an