Multiple Choice

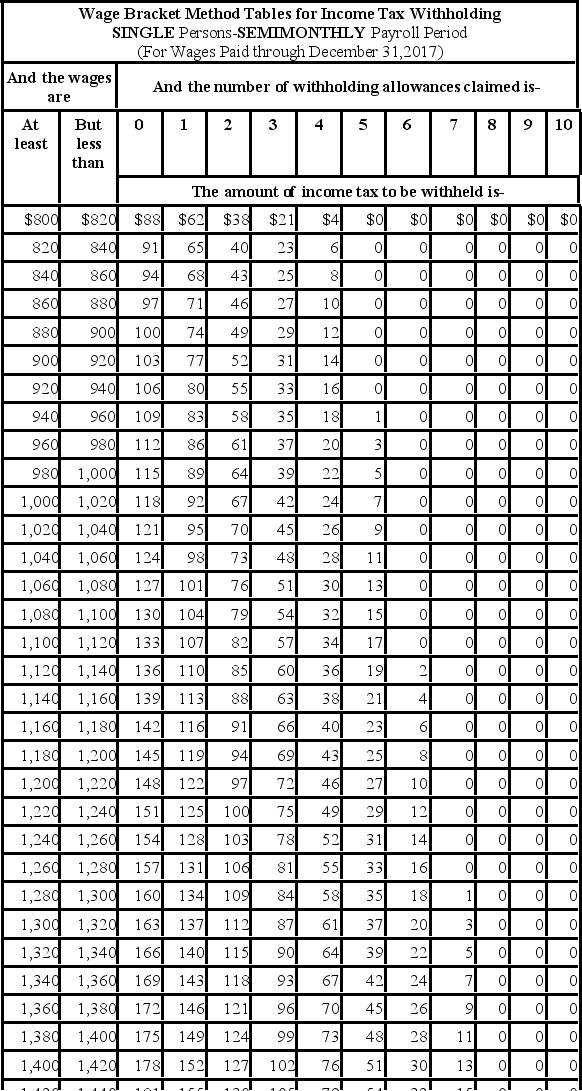

Max earned $1,019.55 during the most recent semimonthly pay period. He is single with 1 withholding allowance and has no pre-tax deductions. Using the following table, how much should be withheld for federal income tax?

A) $118.00

B) $121.00

C) $95.00

D) $92.00

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q8: Why might an employee elect to have

Q9: Collin is a full-time exempt employee in

Q12: Which are steps in the net pay

Q15: Manju is a full-time exempt employee living

Q17: Renee is a salaried exempt employee who

Q18: The wage-bracket of determining federal tax withholding

Q18: Which of the following states do not

Q20: Computation of net pay involves deducting mandatory

Q35: Amity is an employee with a period

Q61: Why do employers use checks as an