Multiple Choice

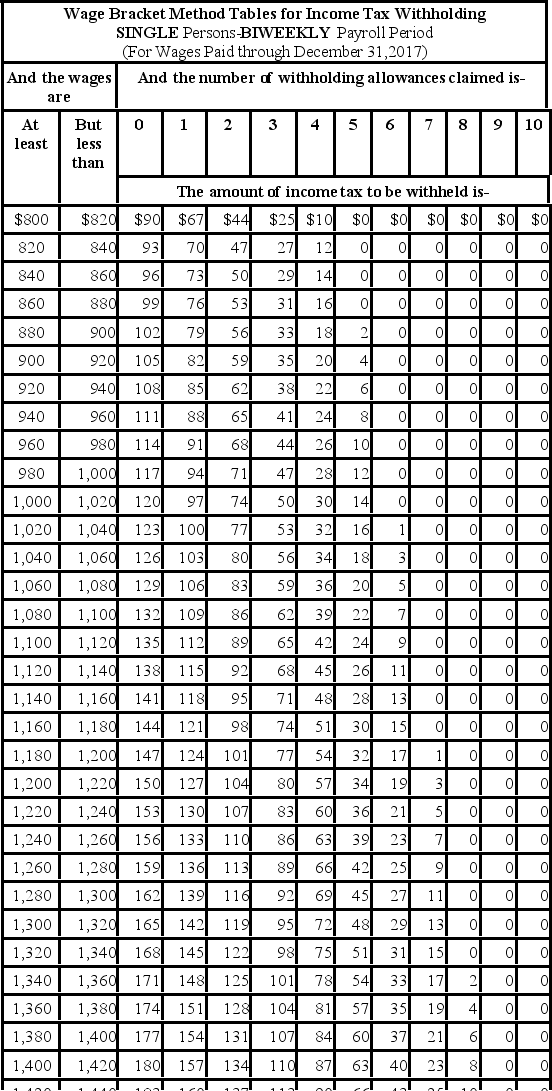

Tierney is a full-time nonexempt salaried employee who earns $990 per biweekly pay period. She is single with 1 withholding allowance and both lives and works in Maryland. Assuming that she had no overtime, what is the total of her Federal and state taxes for a pay period? (Use the wage-bracket tables. Maryland state income rate is 2.0%. Round final answer to 2 decimal places.)

A) $124.25

B) $113.80

C) $115.95

D) $110.78

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Which of the following payment methods is

Q29: Jesse is a part-time nonexempt employee in

Q30: Best practices for paying employees by check

Q32: Nickels Company is located in West Virginia

Q33: The regular Medicare tax deduction is 1.45%

Q35: Sammy contributes 4% of her salary to

Q37: Warren is a married employee with six

Q38: Amanda is a full-time exempt employee in

Q39: How are income taxes and FICA taxes

Q50: Paolo is a part-time security guard for