Multiple Choice

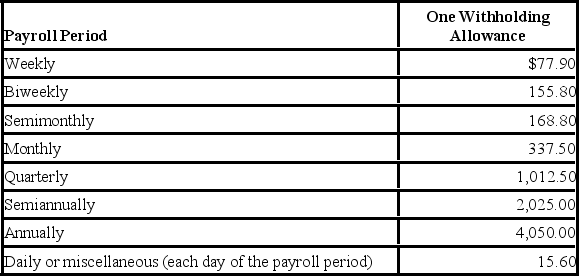

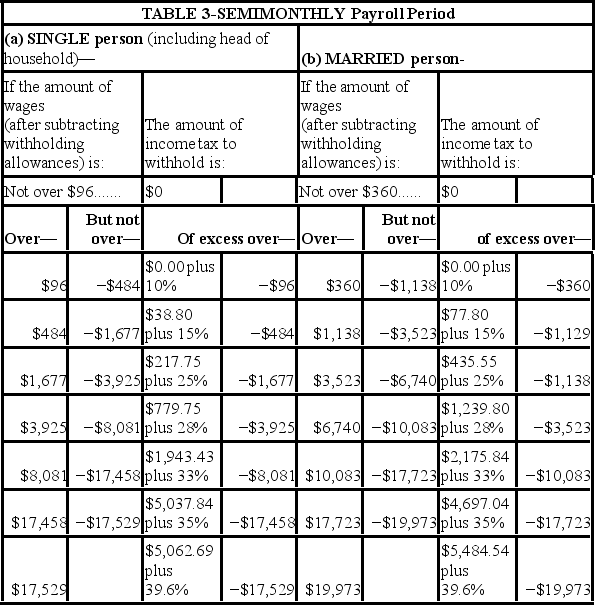

Collin is a full-time exempt employee in Juneau, Alaska, who earns $135,000 annually and has not yet reached the Social Security wage base. He is single with 1 withholding allowance and is paid semimonthly. He contributes 3% per pay period to his 401(k) and has pre-tax health insurance and AFLAC deductions of $150 and $25, respectively. Collin has a child support garnishment of $300 per pay period. What is his net pay? (Use the percentage method. Do not round interim calculations, only round final answer to two decimal points.) Table 5. Percentage Method-2017 Amount for One Withholding Allowance

Federal Income tax using percentage method

A) $3,353.05

B) $3,452.08

C) $3,274.60

D) $3,585.14

Correct Answer:

Verified

Correct Answer:

Verified

Q2: When a payroll check is subject to

Q6: The use of paycards as a means

Q8: Why might an employee elect to have

Q12: Which are steps in the net pay

Q13: Max earned $1,019.55 during the most recent

Q20: Computation of net pay involves deducting mandatory

Q25: What role does the employer play regarding

Q35: Amity is an employee with a period

Q45: What payroll-specific tool is used to facilitate

Q61: Why do employers use checks as an