Multiple Choice

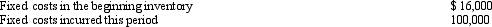

The following information regarding fixed production costs from a manufacturing firm is available for the current year:  Which of the following statements is not true?

Which of the following statements is not true?

A) The maximum amount of fixed production costs that this firm could deduct using absorption costs in the current year is $116,000.

B) The maximum difference between this firm's the current year income based on absorption costing and its income based on variable costing is $16,000.

C) Using variable costing, this firm will deduct no more than $16,000 for fixed production costs.

D) If this firm produced substantially more units than it sold in the current year, variable costing will probably yield a lower income than absorption costing.

Correct Answer:

Verified

Correct Answer:

Verified

Q44: The estimated maximum potential activity for a

Q60: Cost allocation is the assignment of _

Q63: On December 30, a fire destroyed most

Q66: Oakwood Corporation Oakwood Corporation produces a single

Q73: Absorption costing differs from variable costing in

Q101: The measure of activity that allows for

Q105: When using the high-low method,fixed costs are

Q119: If a company used two overhead accounts

Q167: The slope of a regression line is

Q173: Which of the following statements is true