Essay

On December 30, a fire destroyed most of the accounting records of the Alcorn Division, a small one-product manufacturing division that uses standard costs and flexible budgets. All variances are written off as additions to (or deductions from) income; none are pro-rated to inventories. You have the task of reconstructing the records for the year. The general manager informs you that the accountant has been experimenting with both absorption costing and variable costing.

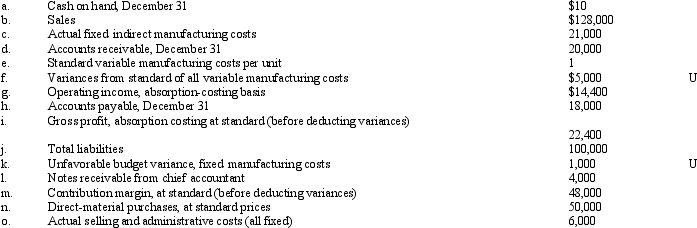

The following information is available for the current year:

Required:

Required:

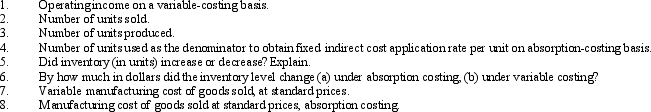

Compute the following items (ignore income tax effects).

Correct Answer:

Verified

Correct Answer:

Verified

Q44: The estimated maximum potential activity for a

Q60: Cost allocation is the assignment of _

Q62: The following information regarding fixed production costs

Q66: Oakwood Corporation Oakwood Corporation produces a single

Q68: Jordan Corporation has developed the following flexible

Q73: Absorption costing differs from variable costing in

Q101: The measure of activity that allows for

Q105: When using the high-low method,fixed costs are

Q119: If a company used two overhead accounts

Q173: Which of the following statements is true