Multiple Choice

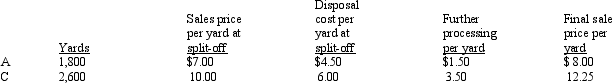

Johnson Company Ellis Company produces two products from a joint process: A and C. Joint processing costs for this production cycle are $9,000. If A and C are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.

If A and C are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.

Refer to Johnson Company. Using sales value at split-off, what amount of joint processing cost is allocated to Product C (round to the nearest dollar) ?

A) $2,938

B) $3,682

C) $4,500

D) $6,062

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Approximated net realizable value at split-off for

Q32: Ellis Company Ellis Company produces two products

Q35: Incremental revenues and costs need to be

Q38: Kellman Company Kellman Company manufactures products X

Q39: Which of the following has sales value?

Q42: Brite Surface Company Brite Surface Company produces

Q57: The primary distinction between by-products and scrap

Q65: Joint costs may be allocated to by-products

Q89: A product may be processed beyond the

Q121: A single process in which one product