Multiple Choice

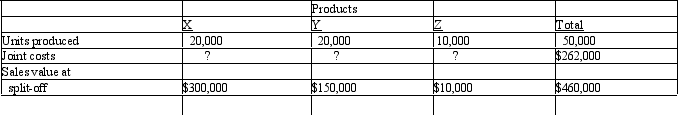

Kellman Company Kellman Company manufactures products X and Y from a joint process that also yields a by-product, Z. Revenue from sales of Z is treated as a reduction of joint costs. Additional information is as follows: Joint costs were allocated using the sales value at split-off approach.

Joint costs were allocated using the sales value at split-off approach.

Refer to Kellman Company. The joint costs allocated to product X were

A) $ 84,000

B) $100,800.

C) $150,000.

D) $168,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Approximated net realizable value at split-off for

Q15: The point at which individual products are

Q35: Incremental revenues and costs need to be

Q37: Johnson Company Ellis Company produces two products

Q39: Which of the following has sales value?

Q42: Brite Surface Company Brite Surface Company produces

Q57: The primary distinction between by-products and scrap

Q65: Joint costs may be allocated to by-products

Q89: A product may be processed beyond the

Q121: A single process in which one product