Essay

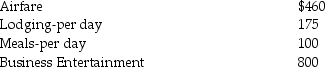

Richard traveled from New Orleans to New York for both business and vacation.He spent 4 days conducting business and some days vacationing.He incurred the following expenses:

What is his miscellaneous itemized deduction (before the floor),assuming Richard is an employee and is not reimbursed,under the following two circumstances?

What is his miscellaneous itemized deduction (before the floor),assuming Richard is an employee and is not reimbursed,under the following two circumstances?

a.He spends three days on vacation,in addition to the business days.

b.He spends six days on vacation,in addition to the business days.

Correct Answer:

Verified

If personal days ex...

If personal days ex...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Avantra Inc.is a professional firm with the

Q18: Which of the following is true about

Q29: An employer contributing to a qualified retirement

Q37: Unreimbursed employee business expenses are deductions for

Q45: Ron obtained a new job and moved

Q49: Feng,a single 40 year old lawyer,is covered

Q86: Taxpayers may use the standard mileage rate

Q217: At her employer's request, Kim moves from

Q1239: Fiona is about to graduate college with

Q1743: Discuss the tax treatment of a nonqualified