Multiple Choice

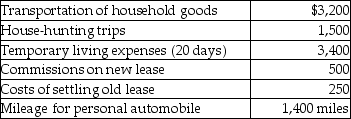

Ron obtained a new job and moved from Houston to Washington.He incurred the following moving expenses:  Assuming Ron is eligible to deduct his moving expenses,what is the amount of the deduction?

Assuming Ron is eligible to deduct his moving expenses,what is the amount of the deduction?

A) $3,466

B) $6,600

C) $9,066

D) $8,366

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Which of the following is true about

Q29: An employer contributing to a qualified retirement

Q34: Nonqualified deferred compensation plans can discriminate in

Q37: Unreimbursed employee business expenses are deductions for

Q47: Richard traveled from New Orleans to New

Q49: Feng,a single 40 year old lawyer,is covered

Q55: In-home office expenses for an office used

Q86: Taxpayers may use the standard mileage rate

Q217: At her employer's request, Kim moves from

Q1239: Fiona is about to graduate college with