Multiple Choice

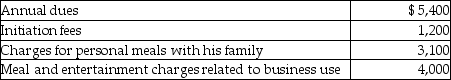

Joe is a self-employed tax attorney who frequently entertains his clients at his country club.Joe's club expenses include the following:  Assuming the business meals and entertainment qualify as deductible entertainment expenses,Joe may deduct

Assuming the business meals and entertainment qualify as deductible entertainment expenses,Joe may deduct

A) $2,000.

B) $4,700.

C) $5,300.

D) $4,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Tobey receives 1,000 shares of YouDog! stock

Q41: Gambling losses are miscellaneous itemized deductions subject

Q66: A partnership plans to set up a

Q111: Self-employed individuals receive a for AGI deduction

Q116: Ron is a university professor who accepts

Q123: Ellie,a CPA,incurred the following deductible education expenses

Q124: Tucker (age 52)and Elizabeth (age 48)are a

Q132: Martin Corporation granted a nonqualified stock option

Q144: Hunter retired last year and will receive

Q590: When are home- office expenses deductible?