Multiple Choice

Martin Corporation granted a nonqualified stock option to employee Caroline on January 1,2013.The option price was $150,and the FMV of the Martin stock was also $150 on the grant date.The option allowed Caroline to purchase 1,000 shares of Martin stock.The option itself does not have a readily ascertainable FMV.Caroline exercised the option on August 1,2016 when the stock's FMV was $250.If Caroline sells the stock on September 5,2017 for $300 per share,she must recognize

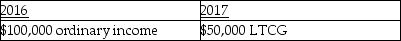

A)

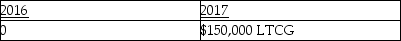

B)

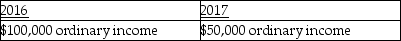

C)

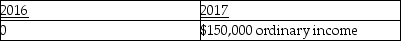

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q41: Gambling losses are miscellaneous itemized deductions subject

Q54: Fin is a self-employed tutor,regularly meeting with

Q59: A sole proprietor establishes a Keogh plan.The

Q66: A partnership plans to set up a

Q111: Self-employed individuals receive a for AGI deduction

Q128: Joe is a self-employed tax attorney who

Q134: The maximum tax deductible contribution to a

Q135: Rajiv,a self-employed consultant,drove his auto 20,000 miles

Q144: Hunter retired last year and will receive

Q590: When are home- office expenses deductible?