Multiple Choice

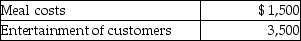

Steven is a representative for a textbook publishing company.Steven attends a convention which will also be attended by many potential customers.During the week of the convention,Steven incurs the following costs in entertaining potential customers.  Having recently been to a company seminar on tax laws,Steven makes sure that business is discussed at the various dinners,and that the entertainment is on the same day as the meetings with customers.Steven is reimbursed $2,000 by his employer under an accountable plan.Steven's AGI for the year is $50,000,and while he itemizes deductions,he has no other miscellaneous itemized deductions.What is the amount and character of Steven's deduction after any limitations?

Having recently been to a company seminar on tax laws,Steven makes sure that business is discussed at the various dinners,and that the entertainment is on the same day as the meetings with customers.Steven is reimbursed $2,000 by his employer under an accountable plan.Steven's AGI for the year is $50,000,and while he itemizes deductions,he has no other miscellaneous itemized deductions.What is the amount and character of Steven's deduction after any limitations?

A) $500 from AGI

B) $500 for AGI

C) $2,000 from AGI

D) $2,000 for AGI

Correct Answer:

Verified

Correct Answer:

Verified

Q2: In determining whether travel expenses are deductible,a

Q21: Which of the following statements is incorrect

Q24: Bill obtained a new job in Boston.He

Q29: Which of the following statements is incorrect

Q30: All of the following are allowed a

Q31: Which of the following is true about

Q31: In-home office expenses which are not deductible

Q33: If an individual is self-employed,business-related expenses are

Q641: If an employee incurs travel expenditures and

Q1888: Deferred compensation refers to methods of compensating