Multiple Choice

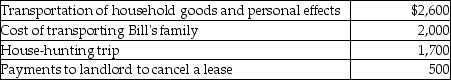

Bill obtained a new job in Boston.He incurred the following moving expenses:  Assuming Bill is entitled to deduct moving expenses,what is the amount of the deduction?

Assuming Bill is entitled to deduct moving expenses,what is the amount of the deduction?

A) $2,600

B) $4,600

C) $6,300

D) $6,800

Correct Answer:

Verified

Correct Answer:

Verified

Q2: In determining whether travel expenses are deductible,a

Q19: David acquired an automobile for $30,000 for

Q21: Which of the following statements is incorrect

Q26: Steven is a representative for a textbook

Q29: Which of the following statements is incorrect

Q31: Which of the following is true about

Q33: If an individual is self-employed,business-related expenses are

Q92: Which of the following statements regarding Coverdell

Q641: If an employee incurs travel expenditures and

Q1888: Deferred compensation refers to methods of compensating