Multiple Choice

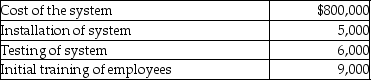

Terra Corp.purchased a new enterprise software system and incurred the following costs:  What is Terra Corp.'s basis in the software system?

What is Terra Corp.'s basis in the software system?

A) $800,000

B) $805,000

C) $811,000

D) $820,000

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q28: On January 31 of this year,Jennifer pays

Q44: Losses are generally deductible if incurred in

Q53: If Houston Printing Co.purchases a new printing

Q62: Section 1221 specifically states that inventory or

Q74: A taxpayer owns 200 shares of stock

Q99: In a community property state,jointly owned property

Q130: Net long-term capital gains receive preferential tax

Q134: Rachel holds 110 shares of Argon Mutual

Q137: On July 25,2015,Marilyn gives stock with a

Q751: What type of property should be transferred