Multiple Choice

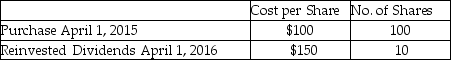

Rachel holds 110 shares of Argon Mutual Fund.She is planning to sell 90 shares.Her record of the share purchases is noted below.What could be her basis for the 90 shares to be sold for purposes of determining gain?

A) $9,000

B) $9,500

C) $9,409

D) Any of the above could be used as basis for the 90 shares sold.

Correct Answer:

Verified

Correct Answer:

Verified

Q28: On January 31 of this year,Jennifer pays

Q34: Everest Inc.is a corporation in the 35%

Q44: Losses are generally deductible if incurred in

Q62: Section 1221 specifically states that inventory or

Q99: In a community property state,jointly owned property

Q121: Joycelyn gave a diamond necklace to her

Q130: Net long-term capital gains receive preferential tax

Q136: Terra Corp.purchased a new enterprise software system

Q137: On July 25,2015,Marilyn gives stock with a

Q751: What type of property should be transferred