Multiple Choice

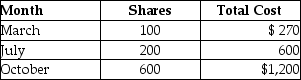

Edward purchased stock last year as follows:  In April of this year,Edward sells 80 shares for $250.Edward cannot specifically identify the stock sold.The basis for the 80 shares sold is

In April of this year,Edward sells 80 shares for $250.Edward cannot specifically identify the stock sold.The basis for the 80 shares sold is

A) $160.

B) $184.

C) $216.

D) $240.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q49: Gina owns 100 shares of XYZ common

Q61: A taxpayer sells an asset with a

Q64: Unlike an individual taxpayer,the corporate taxpayer does

Q69: A nonbusiness bad debt is deductible only

Q80: In the current year,ABC Corporation had the

Q81: Joy purchased 200 shares of HiLo Mutual

Q82: An individual taxpayer who is not a

Q85: All realized gains and losses are recognized

Q88: Kendrick,who has a 33% marginal tax rate,had

Q132: If the shares of stock sold or