Essay

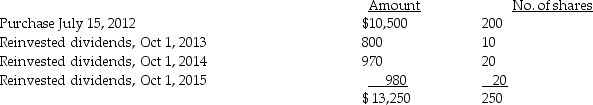

Joy purchased 200 shares of HiLo Mutual Fund on July 15,2012,for $10,500,and has been reinvesting dividends.On December 15,2016,she sells 100 shares.

What is the basis for the shares sold assuming (1)FIFO and (2)average cost method?

What is the basis for the shares sold assuming (1)FIFO and (2)average cost method?

Correct Answer:

Verified

Assuming FIFO,the basis in the...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: The taxable portion of a gain from

Q61: A taxpayer sells an asset with a

Q64: Unlike an individual taxpayer,the corporate taxpayer does

Q77: Mike,a dealer in securities and calendar-year taxpayer,purchased

Q80: In the current year,ABC Corporation had the

Q82: An individual taxpayer who is not a

Q84: Edward purchased stock last year as follows:

Q85: All realized gains and losses are recognized

Q132: If the shares of stock sold or

Q2127: Distinguish between the Corn Products doctrine and