Multiple Choice

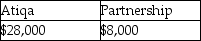

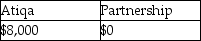

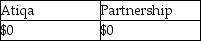

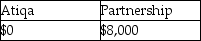

Atiqa receives a nonliquidating distribution of land from her partnership.The partnership purchased the land five years ago for $20,000.At the time of the distribution,it is worth $28,000.Prior to the distribution,Atiqa's basis in her partnership interest is $37,000.Due to the distribution Atiqa and the partnership will recognize income of

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q19: The partnership's assumption of a liability from

Q37: Joy is a material participant in a

Q50: Martha transferred property with a FMV of

Q55: Jamahl has a 65% interest in a

Q70: Passive activity loss limitations apply to S

Q106: Longhorn Partnership reports the following items at

Q110: Empire Corporation has operated as a C

Q116: Which of the following statements is correct,assuming

Q1399: Elise contributes property having a $60,000 FMV

Q1746: What is the primary purpose of Form