Essay

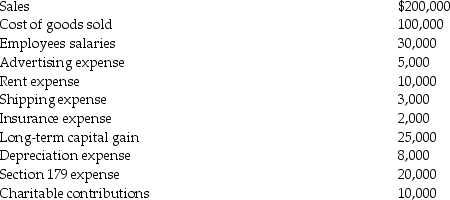

Longhorn Partnership reports the following items at the end of the current year:

What is the partnership's ordinary income? Which items are separately-stated?

What is the partnership's ordinary income? Which items are separately-stated?

Correct Answer:

Verified

Less:

Less:

S...

S...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q37: Joy is a material participant in a

Q50: Martha transferred property with a FMV of

Q55: Jamahl has a 65% interest in a

Q70: Passive activity loss limitations apply to S

Q101: An accounting partnership can become an electing

Q107: Atiqa receives a nonliquidating distribution of land

Q110: Empire Corporation has operated as a C

Q116: Which of the following statements is correct,assuming

Q1399: Elise contributes property having a $60,000 FMV

Q1746: What is the primary purpose of Form