Essay

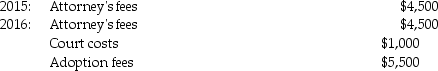

Tyler and Molly,who are married filing jointly with $210,000 of AGI in 2016,incurred the following expenses in their efforts to adopt a child:

The adoption was finalized in 2016 What is the amount of the allowable adoption credit in 2016?

The adoption was finalized in 2016 What is the amount of the allowable adoption credit in 2016?

Correct Answer:

Verified

Qualifying expense:

Less upper income ...

Less upper income ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: Ava has net earnings from self-employment of

Q15: Sam and Megan are married with two

Q28: Carlotta,Inc. ,has $50,000 foreign-source income and $150,000

Q29: During the year,Jim incurs $500,000 of rehabilitation

Q36: ChocoHealth Inc.is developing new chocolate products providing

Q52: A taxpayer who paid AMT in prior

Q63: For purposes of the AMT,only the foreign

Q79: Bonjour Corp.is a U.S.-based corporation with operations

Q115: Beth and Jay project the following taxes

Q246: Nick and Nicole are both 68 years